What is risk management in cybersecurity?

Risk management in cybersecurity refers to the process of identifying, assessing, and prioritizing potential risks and vulnerabilities within an organization's digital infrastructure and data systems. While the technological advancements in IT offer unprecedented convenience and efficiency, they also expose the financial sector to new and sophisticated cyber threats.

"Cybersecurity has become a cornerstone in ensuring stability and integrity of financial systems, playing a crucial role in mitigating risks that could have severe consequences for both institutions and their clients."

The growing threat landscape:

The financial sector is a prime target for cybercriminals due to the vast amounts of sensitive information and assets it handles. From ransomware attacks to sophisticated phishing schemes, the threat landscape is constantly evolving. In recent years, the financial industry has witnessed a surge in cyber-attacks that aim to exploit vulnerabilities in digital infrastructure.

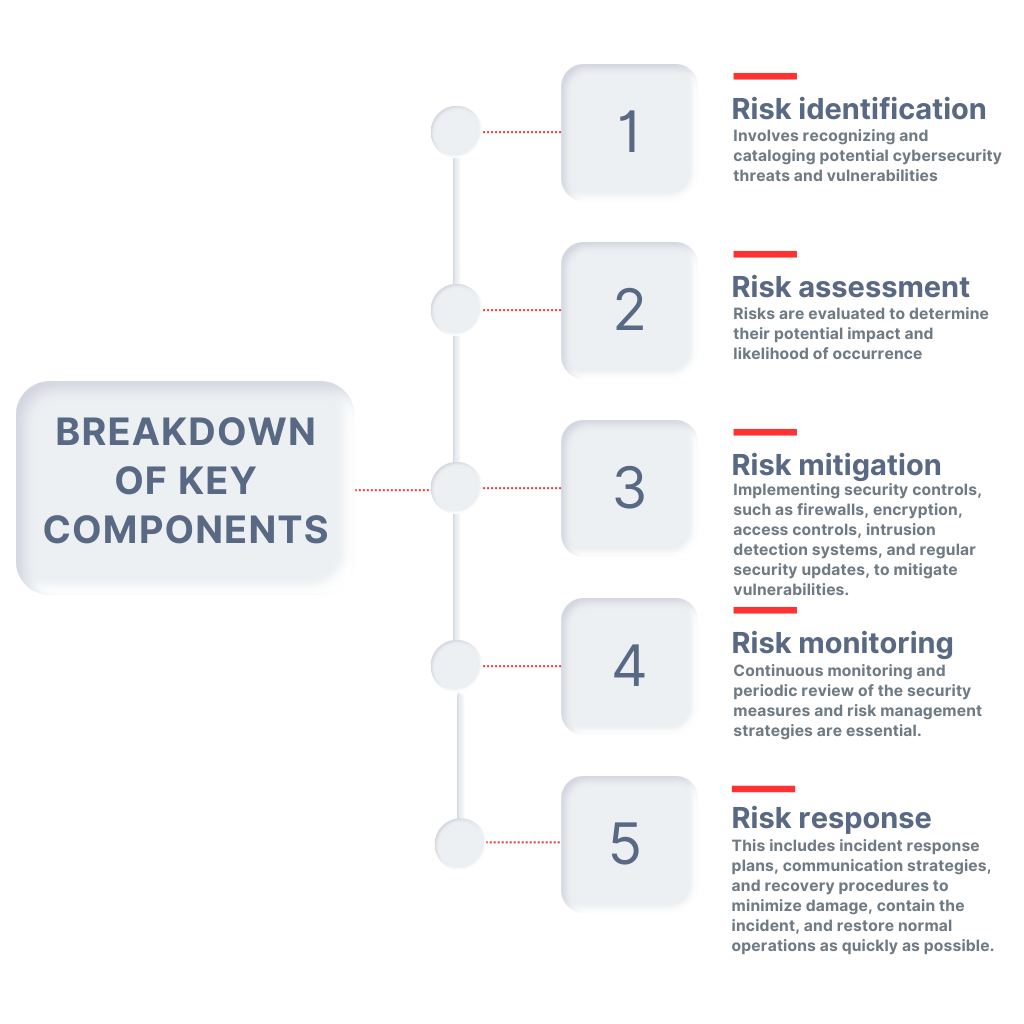

Let's break down some of the key components of risk management:

Financial institutions as prime targets:

Financial institutions, including banks, investment firms, and insurance companies, are prime targets for cybercriminals seeking financial gain. A successful cyber-attack can result in significant financial losses, reputational damage, and legal repercussions. As technology continues to advance, the attack surface for cyber threats expands, making it imperative for financial organizations to stay ahead in terms of cybersecurity measures.

To look at some of the top cyber threats faced by financial sectors, Click here to visit our blog.

Data protection and regulatory compliance:

The financial industry operates within a regulatory framework that mandates the protection of customer data and financial assets. Cybersecurity is essential for ensuring compliance with regulations such as GDPR, PCI DSS, and others that impose stringent requirements on the handling and protection of sensitive information. Failure to comply with these regulations can lead to severe penalties, loss of customer trust, and damage to an institution's reputation.

Securing financial transactions:

The backbone of financial operations lies in secure and reliable transactions. Cybersecurity measures are crucial to safeguarding the integrity of financial transactions, preventing unauthorized access, and ensuring the confidentiality of sensitive information. Technologies such as blockchain are being increasingly employed to enhance the security and transparency of financial transactions.

Incident response and business continuity:

Despite robust cybersecurity measures, incidents may still occur. A comprehensive incident response plan is essential for minimizing the impact of a cyber-attack. Financial institutions must have strategies in place to detect and respond to incidents swiftly, ensuring business continuity and limiting financial losses.

The role of Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML technologies have become invaluable tools in cybersecurity. These technologies enable the development of advanced threat detection systems, behavior analytics, and predictive analysis to identify and respond to potential risks in real-time. Financial institutions are increasingly leveraging AI and ML to stay one step ahead of cyber threats.

Employee training and awareness:

Human error remains a significant factor in cybersecurity breaches. Financial institutions must invest in ongoing training programs to educate employees about the latest cyber threats and best practices for security. Building a culture of cybersecurity awareness is essential for creating a collective defense against potential threats.

Conclusion:

In an era where digitalization is reshaping the financial landscape, cybersecurity emerges as a critical component of risk management. Financial institutions must continually adapt their cybersecurity strategies to address the evolving threat landscape, comply with regulations, and safeguard the trust of their clients. By integrating advanced technologies, fostering a cybersecurity-conscious culture, and prioritizing regulatory compliance, the financial industry can effectively manage and mitigate the risks posed by cyber threats.

About Positka:

Being a Splunk Singapore partner, Positka specializes in high-end technology solutions to help businesses improve their overall IT infrastructure. Founded in 2014, our services include Splunk Services, Cybersecurity & Risk Management, Security Awareness Training, Managed security services, Lean Process Optimization, Robotic Process Enablement Services and Solutions while partnering with other top-tier companies like SentinelOne and so on. We are headquartered in Singapore and operate across India, the US and UK as well.